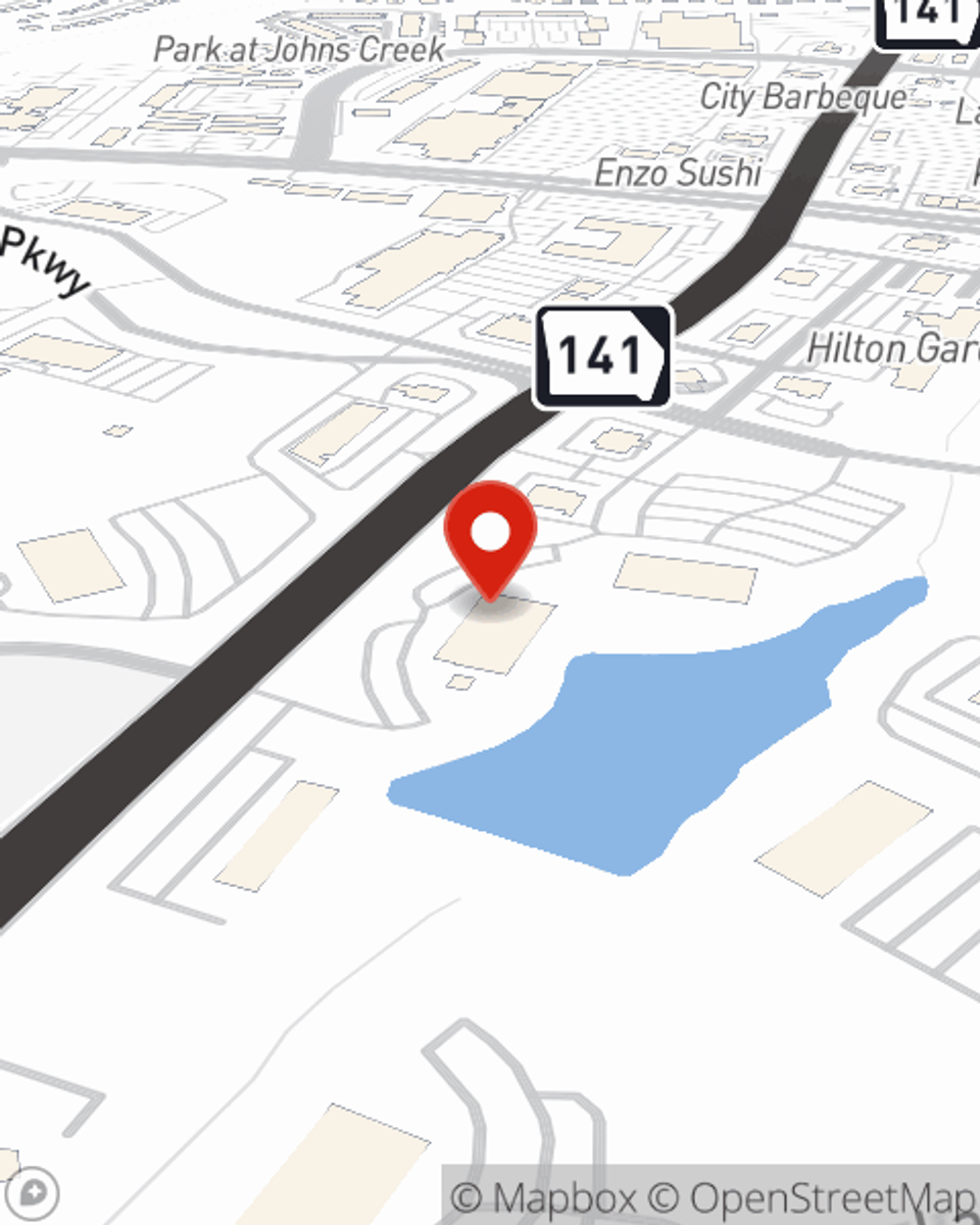

Homeowners Insurance in and around Johns Creek

Looking for homeowners insurance in Johns Creek?

The key to great homeowners insurance.

Would you like to create a personalized homeowners quote?

- Milton

- Alpharetta

- Cumming

- Suwanee

- Peachtree Corners

- Norcross

- Roswell

- Dunwoody

- Duluth

- Lawrenceville

- Birmingham, Alabama

- Huntsville, Alabama

- Gadsden, Alabama

- Madison, Alabama

- Chattanooga, TN

- Nashville, Tennessee

- Franklin, Tennessee

- Memphis, Tennessee

- Brentwood, Tennessee

Home Sweet Home Starts With State Farm

New home. New adventures. State Farm homeowners insurance. They go hand in hand. And not only can State Farm help protect your home in case of tornado or windstorm, but it can also be beneficial in specific legal situations. If someone were to hold you financially accountable if they hurt themselves in your home, the right homeowners insurance may be able to cover the cost.

Looking for homeowners insurance in Johns Creek?

The key to great homeowners insurance.

Agent Katherine Ball, At Your Service

With this terrific coverage, no wonder more homeowners prefer State Farm as their home insurance company over any other insurer. Agent Katherine Ball would love to help you get the policy information you need, just call or email them to get started.

As a leading provider of home insurance in Johns Creek, GA, State Farm strives to keep your valuables protected. Call State Farm agent Katherine Ball today and see how you can save.

Have More Questions About Homeowners Insurance?

Call Katherine at (678) 935-3520 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Extension cord safety: What to do and what to avoid

Extension cord safety: What to do and what to avoid

An extension cord is handy to have in the home or office, but without caution it can become a fire hazard. Here are tips for using an extension cord safely.

What to do if you can’t pay rent

What to do if you can’t pay rent

Many people may need short-term help with rent payments. Whether due to job loss or unexpected costs, these options could help.

Katherine Ball

State Farm® Insurance AgentSimple Insights®

Extension cord safety: What to do and what to avoid

Extension cord safety: What to do and what to avoid

An extension cord is handy to have in the home or office, but without caution it can become a fire hazard. Here are tips for using an extension cord safely.

What to do if you can’t pay rent

What to do if you can’t pay rent

Many people may need short-term help with rent payments. Whether due to job loss or unexpected costs, these options could help.